The pundits have been proclaiming since long that the equities markets are going nowhere unless the investment grade (IG) corporate bonds market picks up.

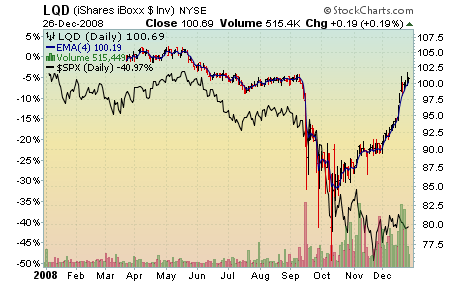

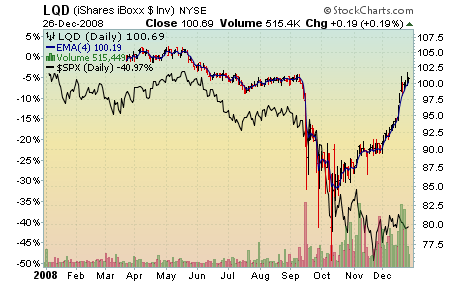

The chart below shows that a rally in earnest did start for the LQD (iShares iBoxx ETF IG Corporate bonds) starting from December. Note the increase in volume and price at the same time. At the same time, the equities market have moved sideways only (the black line trending downwards). The IG market is now at the levels prior to Sept. 15th when the Fed did not bail out Lehman (a truly historic event for the global economy).

Investment Grade corporate bonds

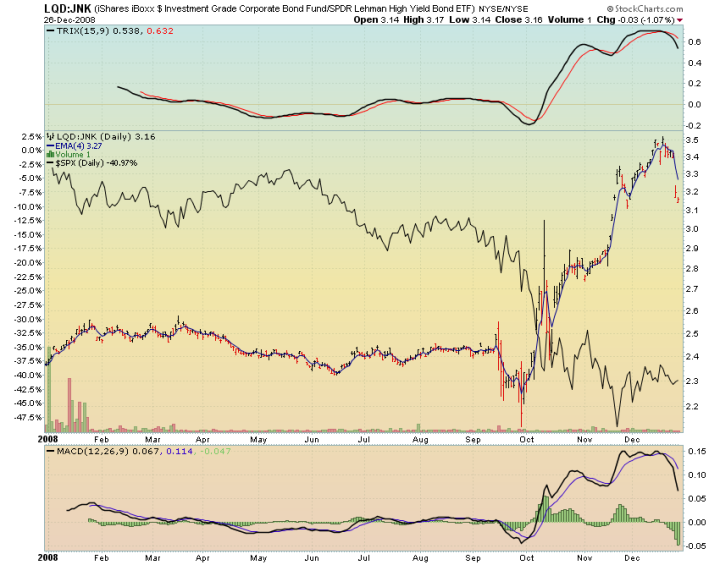

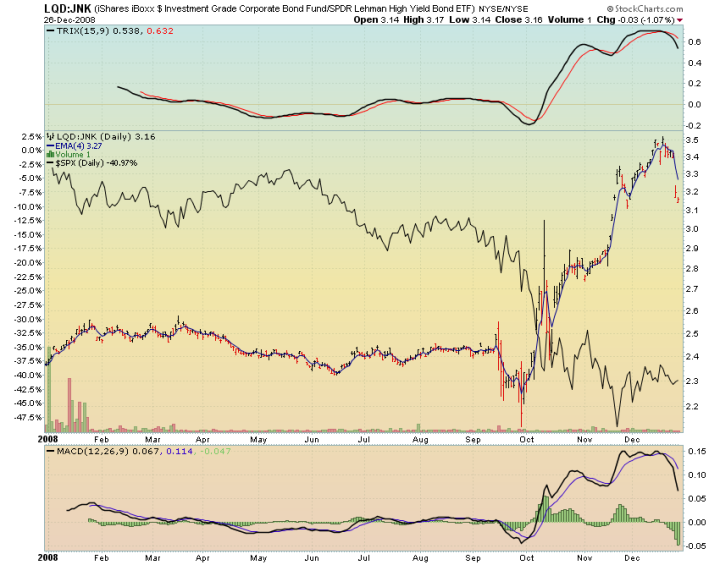

While the investment grade corporates did rally from the October lows, the junk bond markets (as tracked by JNK: Lehman’s ETF) failed to rally. Only recently did JNK turn around. That rally has been extremely impressive on high volume.

Junk Grade corporate bonds

What is more important is where the money has been flowing of late since that would provide a window on the risk-appetite for institutional investors. The next chart compares the returns on the ratio of investment grade corporates to the junk grade corporates. The trend of favoring investment grade over junk grade has been clearly broken this week. It will be interesting to see if the new trend persists implying that Junk grade corporates are in favor now.

The institutional risk appetite returned this past week. Assuming all else being the same, equity markets should be poised for a healthy gain from an intermediate term perspective, if not from a long term perspective.

Investment Grade vs. Junk Grade Corporate Bond Returns

[…] Here is where things get interesting. We are far worse off on US Federal Budget Deficit (add stimulus to it and things are bleak), Investment Grade Spread (don’t trust the best for keeping our money), BAA spread (don’t even have a risk-appetite to invest in risky companies), and equity market performance (the best indicator of 6/8 months in the future). BAA spread and Investment Grade Spreads are improve dramtically. […]

[…] Risk-Appetite Strong Posted in Investment by Sanjay Bapna on January 5th, 2009 Following up on my post on Investment Risk-Appetite returning. […]